Understanding The Two-Pot Retirement System

By Evolution Finance at 10 May 2024, 11:20 AM

By Evolution Finance at 10 May 2024, 11:20 AM

Understanding The Two-Pot Retirement System

What Is It?

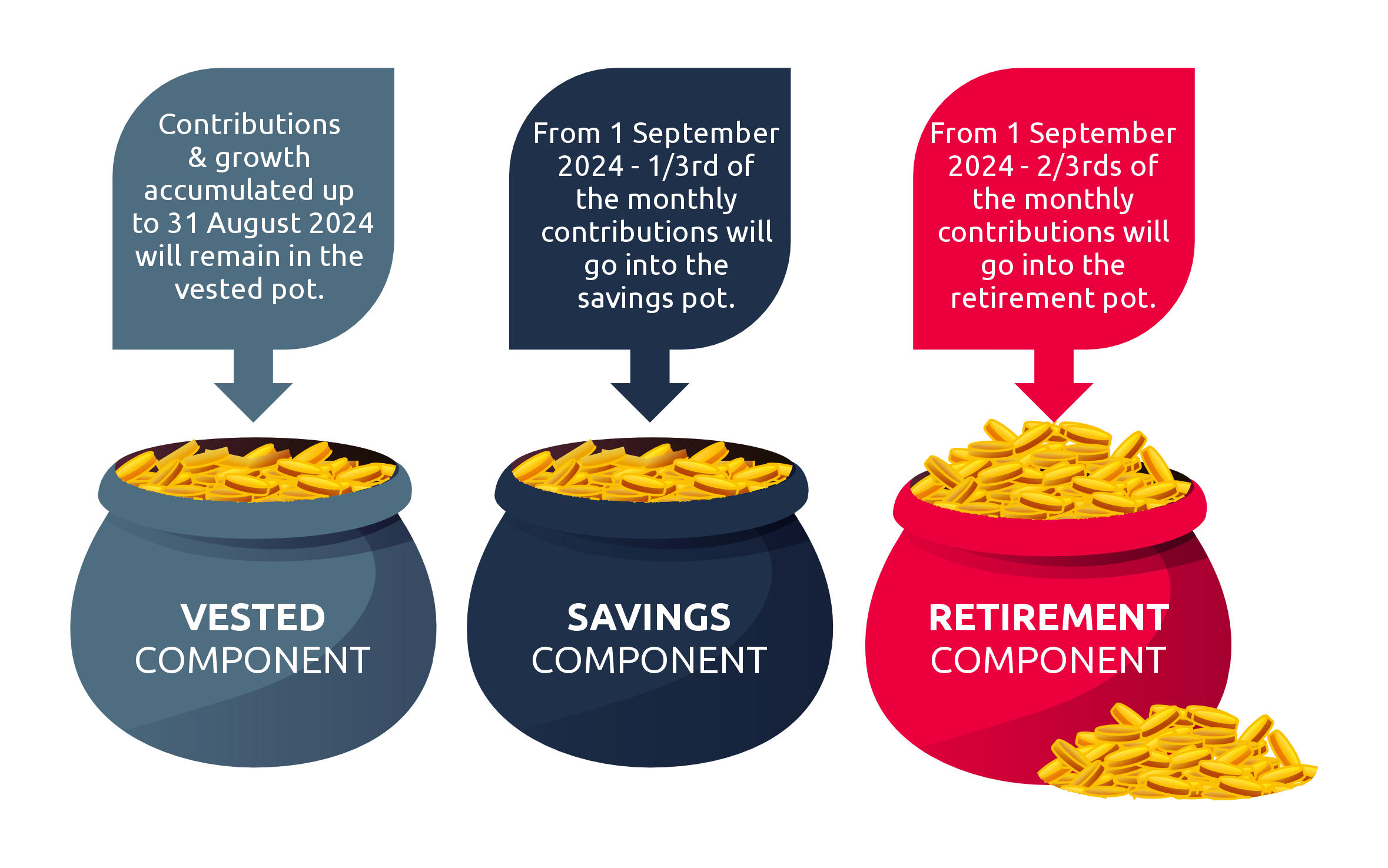

The Two-Pot Retirement System is a recent reform that aims to improve retirement outcomes, while providing flexibility for fund members facing financial difficulties. Here’s how it works:

Two Components:

Savings Component: This pot allows partial withdrawals from retirement funds before retirement. It’s accessible if you’re in financial distress.

Retirement Component: This portion can only be accessed at retirement. It ensures long-term preservation of retirement savings.

Who Is It For?

All Retirement Funds: The new system applies to both private sector and public sector funds.

Exclusions: It doesn’t apply to old-generation retirement annuity policies or funds with no active participating members.

Pensioners: Members of provident funds aged 55 and older on March 1, 2021, who haven’t opted for the two-pot system are excluded.

Why the Change?

Balancing Act: The system balances long-term savings with flexibility during financial hardship.

Avoiding Resignations: Under the old system, some members resigned to access their retirement savings, which wasn’t ideal.

How Does It Work?

Contributions Split:

From 01 September 2024, contributions are split:

Savings Component:

1/3 (one-third) of total contributions.

Retirement Component: 2/3 (two-thirds) of total contributions.

Example: If your monthly contribution is R900, R300 goes to savings, and R600 to retirement.

Withdrawals:

You can withdraw from the savings component (minimum R2,000) once per tax year.

Use this sparingly—remember, it’s for emergencies.

Amounts remain available for future withdrawals, with tax-free growth.

Remember, the two-pot system aims to balance flexibility and long-term security.